April

Contact

Wayne Miller

Professor-Extension Economist

CPED

Email: wmiller@uada.edu

University of Arkansas System Division of Agriculture

Cooperative Extension Service

2301 S. University Avenue

Little Rock, AR 72204

COVID Expected to Substantially Decrease County Government Revenue

The COVID-19 pandemic is expected to have a substantial impact on local government revenue in 2020, in part from a decline in revenue from the local sales and use taxes.1

Increased unemployment due to COVID-19 is expected to reduce consumer spending and, therefore, cause a decline in sales tax revenue. Since economic forecasts suggest that some of the hardest hit sectors include retail trade, arts, entertainment and recreation, and accommodation and food services, sales tax revenue is expected to decline substantially.

The decline in sales tax revenue will have a substantial impact on the many counties that rely heavily on their local sales tax revenue to pay for the services they provide to residents and businesses.2

In 2017, the local sales tax generated more revenue for county governments statewide than any other single revenue source. County governments statewide received one-fourth of their total revenue from the local sales tax in 2017. Therefore, a decline in sales tax revenue will likely affect their ability to provide needed infrastructure and services.

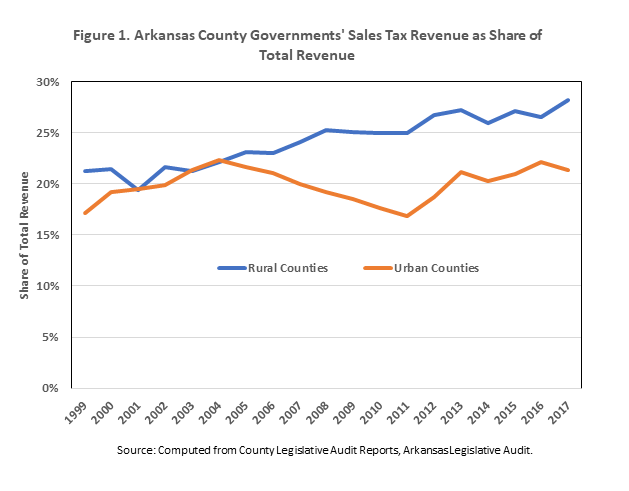

Rural counties3 are more dependent on local sales tax revenue than urban counties and their dependence on the sales tax is growing4, making them more vulnerable to fluctuations in the economy. In 2017, rural counties received approximately 28% of their revenue from the county sales tax compared to 21% in urban counties (Figure 1).

Rural counties generated only 19% of their revenue from the county sales tax in 2001 compared to 28% in 2017. Since sales tax revenue fluctuates with the state of the economy, and because rural county governments are more dependent on sales tax revenue, the COVID-19-led recession is expected to greatly impact the ability of rural counties to generate revenue to pay for infrastructure and services.

Although rural county governments on average are more dependent on the local sales tax to generate revenue, their reliance on the local sales tax varies greatly, ranging from 0% in one county to 61% in another. Therefore, the short-term impact of COVID-19 on the ability of county governments to generate revenue in 2020 will vary greatly among rural counties in the state.

There are two mitigating factors that will reduce the effect of the COVID-19 led recession on local government revenue. First, as of January 1, 2020 counties and municipalities began collecting sales tax revenue from remote sellers due to legislation passed by the Arkansas Legislature in 2019.

Second, the Coronavirus Aid, Relief and Economic Security (CARES) Act passed by the U.S. Congress provides some additional funding for families, unemployed workers, and state & local governments.

While these mitigating factors are expected to slow and limit the extent of the recession, they are not expected to provide enough assistance to help local governments avoid making budget cuts in 2020.

Read more about the potential impact on county government finances in this article included in a recent University of Arkansas System publication, Covid-19 Impacts on Arkansas' Agricultural and Rural Economies.

[1] In this document the sales and use tax will be referred to as the sales tax

[2] It should be noted that counties and municipalities also receive other funding from state and local sources, some of which will be affected by the expected downturn in the economy. However, in this blog we only discuss the possible effects of COVID-19 on local county sales tax revenue and county government budgets.

[3] For a definition of rural and urban counties, see the 2019 rural profile of Arkansas https://uaex.uada.edu/ruralprofile

[4] Source: Computed from County Legislative Audit reports, Arkansas Legislative Audit.