YEAREND: War, weather drive 2022 ag rollercoaster

Markets trying to stabilize following a year of COVID disruptions ran straight into drought.

By Mary Hightower

U of A System Division of Agriculture

Dec. 9, 2022

Fast facts:

- Higher input prices nearly negate higher commodity prices

- Spring flooding slows planting

- Summer, harvest-time drought dings prices

(672 words)

(Newsrooms: With sidebar on projected price increases: graphs, file art of Biram)

LITTLE ROCK — Markets seeking stability after a year of COVID found new turbulence in 2022 as war erupted in the Ukraine and Mid-South farmers found themselves on a weather rollercoaster ride.

A spring with too much rain, followed by a summer of too much drought, overshadowed any market optimism going into planting time.

“As farmers were in the field preparing to plant their crop, Russia invaded Ukraine fueling uncertainty across the world and in agricultural input markets,” said Hunter

Biram, extension economist for the University of Arkansas. “We saw prices paid for

chemicals, fertilizer, and fuels increase by about 10 to15 percent over 2021 after

there was a 30 percent increase in the prices paid for chemicals, 60 percent increase

in prices paid for fertilizer, and 50 percent increase in the prices paid for fuels

relative to 2020

“Any potential relief the high commodity prices provided was essentially eliminated

by these increases in input prices,” Biram said.

According to the 2023 Division of Agriculture crop enterprise budgets, nitrogen fertilizer is projected to be about 6 percent lower relative to 2022 but still 14 percent higher relative to 2021. Phosphate and potash are projected to be up some over 2022 at around 1.6 percent and 0.5 percent higher, respectively. Diammonium phosphate, known as DAP, and defoliant, key inputs used in cotton production, are projected to be up 7 percent and 10 percent respectively over 2022. Insecticides and fungicides, which are key inputs used in rice production are projected to be up 98 percent and 18 percent, respectively, over 2022.

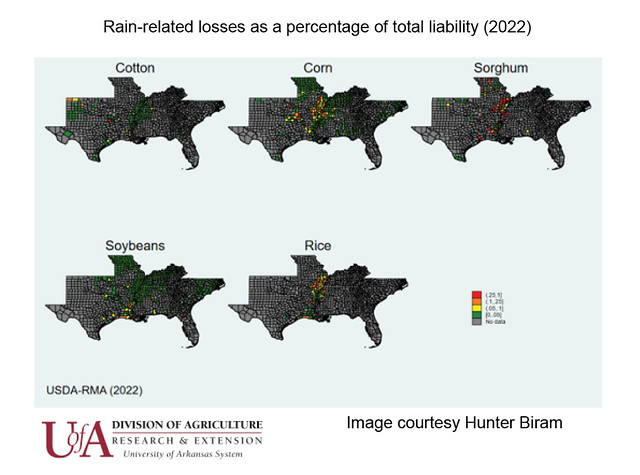

Spring rains came — lots of it — as farmers were getting crops in the ground, slowing progress and worse, “causing a great deal of yield loss. According to the U.S. Department of Agriculture Risk Management Agency, of the $1.4 billion in rain-related losses across the U.S., $0.4 billion were primarily in the Mid-South states,” Biram said. "In Arkansas, we saw $171 million in losses account for half of the total coverage purchased in 2022. Prevented planting claims were the primary driver of losses with 81 percent of the losses directly attributed to prevented planting."

Too much water turned to too little as summer began. Farmers in Arkansas had to make some tough choices.

“Drought struck the entire United States which resulted in significant crop losses in Texas, Oklahoma, and parts of the east coast,” Biram said. “Of the $3.9 billion in total drought-related losses across the U.S., $2.4 billion were in the Southeast.”

Arkansas weathered the drought better than other states, thanks to irrigation. Arkansas ranks third nationally in terms of acres under irrigation. However, the drought would find another way to hit farmers in Arkansas and elsewhere, as it dropped the Mississippi River to historically low levels. The levels were so low, the river was closed to traffic between Osecola and Greenville, Mississippi. Elevator prices followed the river levels.

“These price losses at the local grain elevator came in the form of extremely weak basis during arguably the most unfortunate time: harvest,” Biram said. “During the usual harvest window, basis or the local cash price less the relevant futures price, fell from about 40 cents over to 125 under at Helena, Arkansas.

“Once the river levels increased, basis strengthened to about 50 over and has stayed relatively consistent at this level even though most new crop delivery from the 2022 harvest is finished,” he said.

According to the November estimates from the National Agricultural Statistics Service, Arkansas corn was expected to yield 176 bushels per acre, down from 184 bushels per acre in 2021. Cotton was forecast to yield 1,166 pounds per acre in 2022, compared to the record-setting 1,248 pounds per acre in the previous year. Peanuts were expected to yield 5,000 pounds per acre, same as 2021. All rice was expected to yield 7,450 hundredweight per acre in 2022, down from 7,630 the previous year. Soybeans were expected to improve on 2021, rising to 53 bushels per acre — which would be a new state record average yield — up from 52 bushels the previous year.

To learn about extension programs in Arkansas, contact your local Cooperative Extension

Service agent or visit www.uaex.uada.edu. Follow us on Twitter and Instagram at @AR_Extension. To learn more about Division

of Agriculture research, visit the Arkansas Agricultural Experiment Station website: https://aaes.uada.edu. Follow on Twitter at @ArkAgResearch. To learn more about the Division of Agriculture,

visit https://uada.edu/. Follow us on Twitter at @AgInArk.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture offers all its Extension and Research programs and services (including employment) without regard to race, color, sex, national origin, religion, age, disability, marital or veteran status, genetic information, sexual preference, pregnancy or any other legally protected status, and is an equal opportunity institution.

# # #