March

Contact

Kristin Higgins

Public Policy Center

Phone: 501-671-2160

Email: khiggins@uada.edu

University of Arkansas System Division of Agriculture

Cooperative Extension Service

2301 S. University Avenue

Little Rock, AR 72204

Move Over Spring, March is Property Tax Month in Arkansas

Springtime in Arkansas usually ushers in blooms, campaign signs, and ... property

tax bills. This is the time of year when county tax collectors remind you how much

you owe for your home, car, boat, or cow.

Springtime in Arkansas usually ushers in blooms, campaign signs, and ... property

tax bills. This is the time of year when county tax collectors remind you how much

you owe for your home, car, boat, or cow.

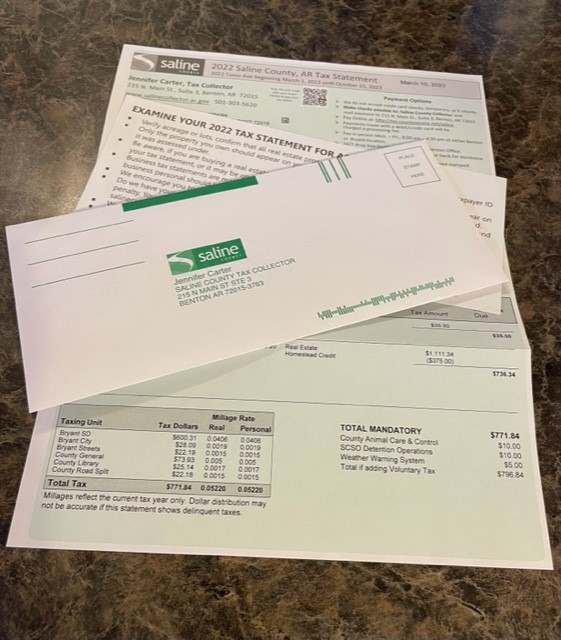

Property owners in Arkansas receive their annual tax bills in March. The deadline to pay this year is Oct. 15, 2023. People who pay their taxes after that date also pay a late fee.

Although the bills come every year, they can still be a surprise especially for new residents. Not every state charges personal property taxes.

Below are some helpful things to know if you are new to paying property taxes in Arkansas.

What Are Real and Personal Taxes?

There's a certain lingo to know when it comes to taxes.

- Real Property taxes refers to real estate, such as land, homes, office buildings, mobile homes,

barns, etc. They are fixed to the ground and do not move. County assessors re-examine

properties every three years to determine their value.

- Personal Property taxes refer to property that moves. Cars, planes, boats, motorcycles, RVs, and livestock are all examples of personal property. Owners are required to report these properties to their county assessor by the end of May each year. Failure to do so results in a late fee.

Individual property tax bills are calculated by multiplying the assessed value of property by the total millage rate for that location. The amount of your property tax bill is determined by two local factors:

- Local property values determine the assessed value of your property.

- Local millage or tax rates determine the amount you pay per $1,000 of assessed value.

In Arkansas, all real and personal property is assessed 20% of market value. So, if you owned a property with a market value of $100,000, you would only be required to pay property taxes on $20,000.

Real life tax mystery: An Arkansas home valued at $150,000 is assessed at $30,024. However, records show a taxable value of $21,290. That's less than 20% of the assessed value. Why? Answer: The house's value increased from 2021 to 2022. Arkansas law caps property tax increases from year to year at 5%.

It's 2023. Why Does My Tax Bill Say 2022?

Property taxes are paid a year behind. The tax bill in the mail now is for property you owned in 2022. Even if you sold a car last year, you are still paying taxes on it.

Haven't received your tax bill yet? Counties have until July to mail it to you. Most don't wait that long.

What Do My Property Taxes Pay For?

Property tax is an important source of revenue for local governments, including school districts and county and city governments. Revenue generated by the property tax is used to finance education, roads, hospitals, libraries, public safety and for the general operation of county and city governments. Property taxes are collected from commercial and industrial establishments, utilities and farms as well as from homeowners and other individuals who own real or personal property.

Read more about how property tax revenues are spent

How Much Is the Homestead Tax Credit?

Since 2007, Arkansas law has provided for an annual state tax credit for primary dwellings. You must apply for the homestead tax credit at your county assessor's office. If you buy a new house and move, you must reapply for your homestead credit.

Property tax bills in the mail this year will show a $375 homestead credit. Next year, the amount shown on your 2023 tax bill will be $425 thanks to House Bill 1032 passed recently in the Arkansas General Assembly. (The bill awaits the governor's signature and will then become law).

Counties and cities are reimbursed for the credit with revenues from a half-cent sales tax in the state's Property Tax Relief Trust Fund.

What Are These Optional Taxes on My Bill?

In a third of Arkansas counties, there’s an extra line on the annual bill for voluntary property taxes to help pay for specific services.

These services have included animal shelters and spay/neuter programs; county jails; cemetery upkeep; police, fire or ambulance services; roads; parks and recreation; soil conservation; weather alert programs; libraries and museums. Voluntary taxes charged in Arkansas have ranged from an additional $2 to $10 each on a bill depending on the community.

Unlike regular property taxes for their houses and vehicles, property owners have a choice whether to pay the voluntary taxes listed on their annual property tax statements. The voluntary tax dollar amount is the same for every property owner in the community.

Read more about voluntary property taxes.

How to Appeal Your Tax Bill

If you think your property value and taxes don't add up, you can appeal to the county Board of Equalization. Start the process by contacting your county clerk office for more information.

The equalization board serves a vital role in the assessment and collection of all property taxes. Each county has its own equalization board composed of five to nine citizens, depending on population size. Board members are appointed by the county judge, the mayors of the principal cities of the county, the school districts and the county quorum court (Arkansas Code 26-27-304). The county clerk or clerk’s designee serves as secretary for the equalization board.

Benton County offers some tips on preparing for the process.

Don't Forget to Assess Your Car or Boat

May 31 is the deadline to contact your county assessor to assess your personal property. It's an easy phone call and many counties now offer this service online. If you miss the date, be prepared to pay a late fee.