Posts

Contact

Kristin Higgins

Public Policy Center

Phone: 501-671-2160

Email: khiggins@uada.edu

University of Arkansas System Division of Agriculture

Cooperative Extension Service

2301 S. University Avenue

Little Rock, AR 72204

What Are These Voluntary Property Taxes On My Bill?

Property owners in Arkansas recently received their annual property tax bill detailing

how much money they owe their local school districts, counties and cities. Some people

might even see taxes listed for libraries, levees, or special improvement districts.

Property owners in Arkansas recently received their annual property tax bill detailing

how much money they owe their local school districts, counties and cities. Some people

might even see taxes listed for libraries, levees, or special improvement districts.

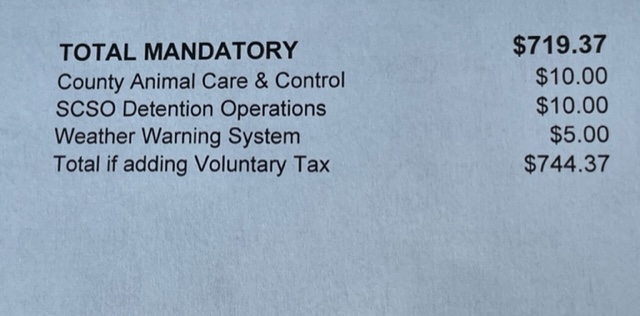

In a third of Arkansas counties, there’s an extra line on the annual bill for voluntary property taxes to help pay for specific services.

These services have included animal shelters and spay/neuter programs; county jails; cemetery upkeep; police, fire or ambulance services; roads; parks and recreation; soil conservation; weather alert programs; libraries and museums. Voluntary taxes charged in Arkansas have ranged from an additional $2 to $10 each on a bill depending on the community.

Unlike regular property taxes for their houses and vehicles, property owners have a choice whether to pay the voluntary taxes listed on their annual property tax statements. The voluntary tax dollar amount is the same for every property owner in the community.

UCA professors say Arkansas’ voluntary city and county property taxes are unique. Typically there are voluntary federal taxes, such as paying a few dollars for presidential campaigns.

Professors Kim Hoffman and Joseph Yuichi Howard at the University of Central Arkansas found 58 different voluntary taxes levied in the state when they surveyed counties in 2012-2014. Counties reported 36 voluntary taxes and cities charged 22 voluntary taxes. Some counties and cities asked property owners to consider paying multiple voluntary taxes.

How are voluntary property taxes established?

A city council or county quorum court must vote whether to establish a voluntary property tax. A city or county ordinance typically spells out the purpose of the tax, the amount charged and how revenues can be spent.

Arkansas Code 26-25-106 says it’s unlawful for county officials to use voluntary tax dollars for purposes other than it was collected. People familiar with state law told us this portion of state code from 1967 is the only one they know guiding voluntary taxes. The law mentions an election, but historically, county officials have approved their own voluntary taxes while cities have held elections.

Where in Arkansas are voluntary property taxes popular?

According to a map included in the UCA research article, the counties and cities asking property owners to pay voluntary taxes spread across the state, though the southern part of the state is mostly void of these taxes.

Counties big to small charge the tax – Pulaski County’s Quorum Court added voluntary taxes in 2016 after the study came out for a spay/neuter program for animals. Woodruff County, the smallest county in Arkansas population-wise at 6,269 people, also has a voluntary tax for a beaver eradication program.

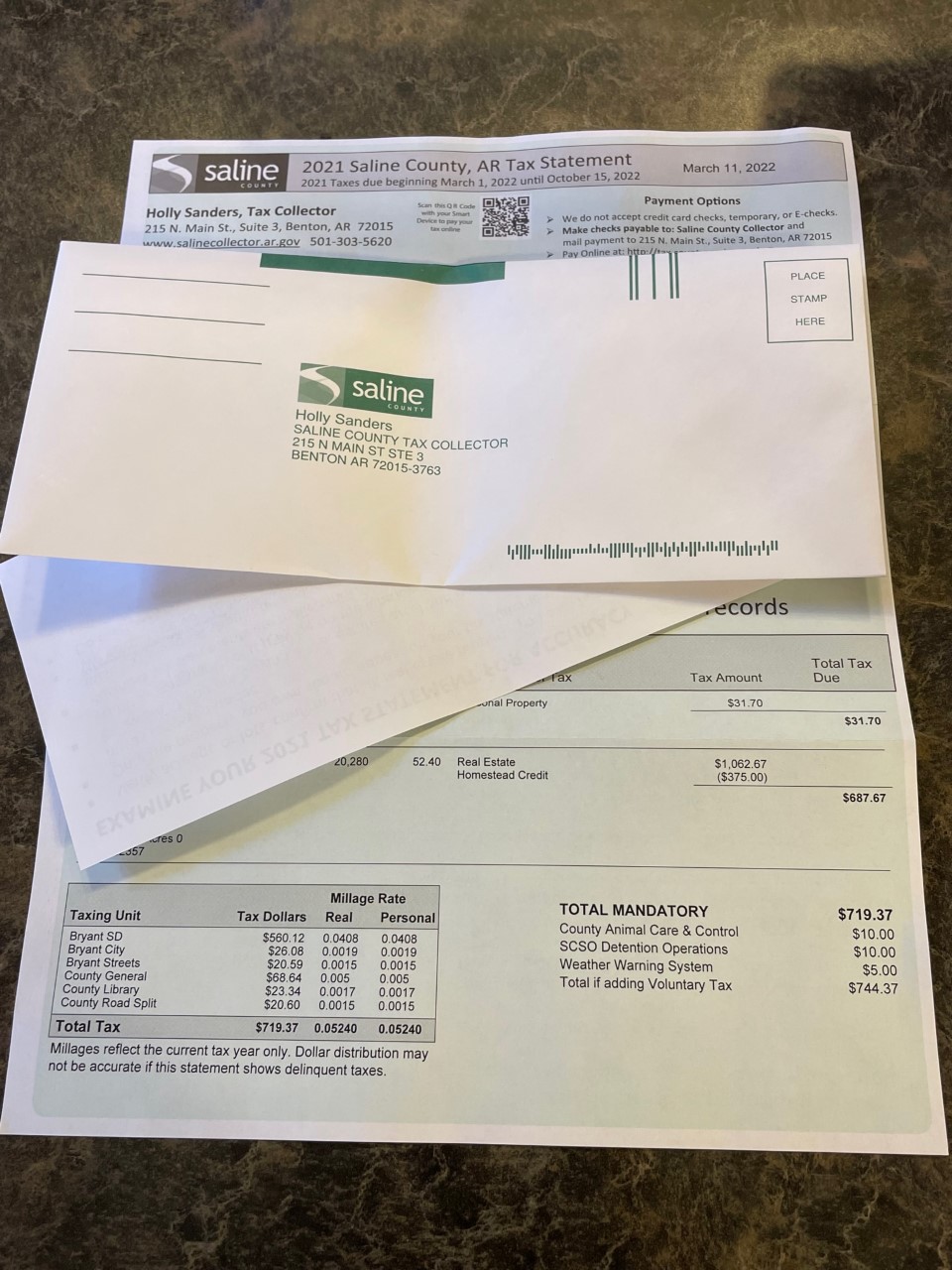

Want to know if your county has a voluntary property tax? Look at your tax statement (see recent Saline County real estate property tax example below) or contact your county tax collector for more information.

County tax collectors send out tax bills in the spring. Property tax payments are

officially due March 1 but you have until October 15 to pay them without a penalty.

The tax bills people receive in 2022 are for their 2021 taxes.

What about regular property taxes? How does my property tax compare?

Property taxes are an important source of revenue for school districts, counties and cities in Arkansas. Property tax revenue helps to fund our K-12 schools, county and city roads and bridges, police and fire departments, libraries and many other social services.

Browse our Arkansas Property Tax resources to learn more about the services provided from property tax revenue, how the property tax is administered and who pays the property tax. This information is provided for every county in the state.

How are property taxes calculated? Read this 2018 blog post on how Arkansas property tax rates are determined.