August

Contact

Ellie Wheeler

CPED

Email: ewheeler@uada.edu

University of Arkansas System Division of Agriculture

Cooperative Extension Service

2301 S. University Avenue

Little Rock, AR 72204

New Reports Highlight Arkansas’ Varied Property Tax Landscape

Owners of property in Arkansas will contribute an estimated $2.7 billion in property

tax revenue in 2020. Although school districts are the primary, and perhaps most well-known

recipients of property taxes, this revenue is also an important part of county and

city budgets.

The 2020 Property Tax Publications provide a unique resource for each of Arkansas’s 75 counties, describing the source and distribution of property tax revenue, property tax rates, trends and potential for revenue as well as national comparisons. In this publication, we provide information to better understand the importance of property tax to pay for schools, roads, public safety and other local services in the state.

You can download a PDF copy of the reports from our website: https://www.uaex.uada.edu/business-communities/local-government/property-taxes.aspx

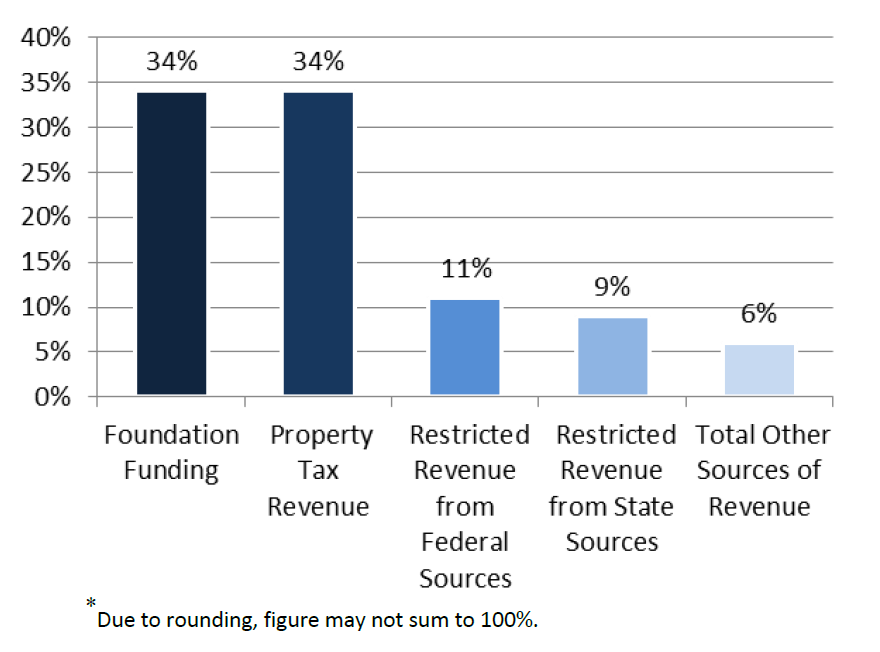

Property tax revenue makes up over a third of the $5.6 billion in total funding that school districts in Arkansas received in the 2018-2019 school year (Figure 1).

With oversight from locally elected school boards, school districts use property tax revenue for many vital expenses, including building construction and maintenance, teacher salaries, school supplies and equipment. Each district’s reliance on property tax to fund their schools varies greatly. In the 2018-2019 school year, property taxes funded as little as 16% (Sevier County) to as much as 55% (Cleburne County) of school district revenue.

Figure 1. School District Revenue by Source, State of Arkansas, 2018-2019 School Year

Source: Arkansas Department of Education Annual Statistical Report

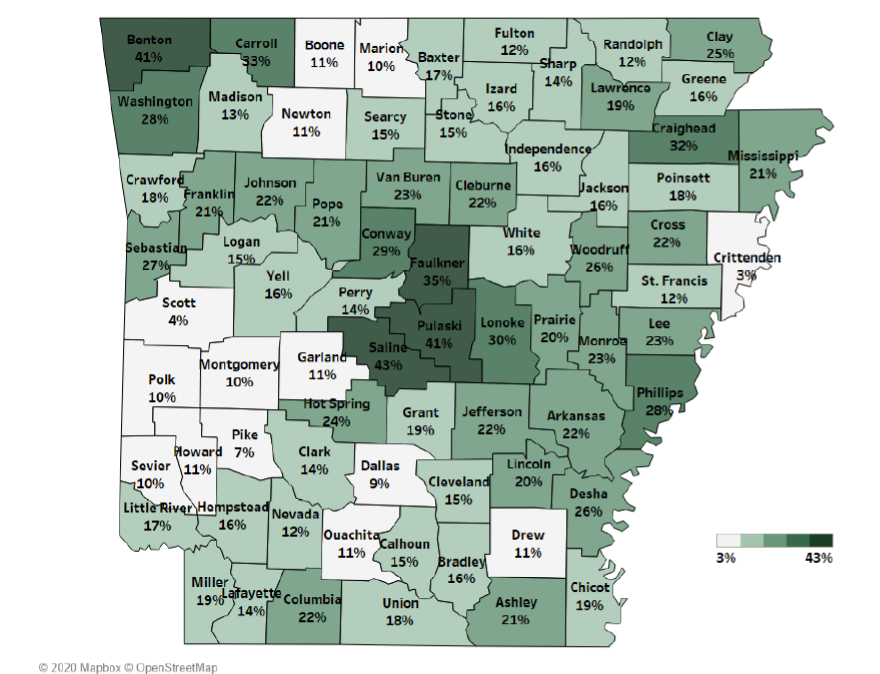

As a whole, county governments in Arkansas also receive a large portion of their total revenue from property taxes. Almost a quarter (23%) of county government revenue in Arkansas came from property taxes in 2017. However, individual counties vary widely in their reliance on property tax revenue, raising between 3% and 43% of total county revenue from property tax in 2017 (Figure 2).

Figure 2. Property Tax revenue as a Percent of Total County revenue, 2017

Source: Computed from Arkansas Department of Legislative Audit reports

While the property tax is an important source of revenue for Arkansas schools and local governments, Arkansans pay some of the lowest property taxes in the nation by several metrics, and our local government’s reliance on property taxes is decreasing.

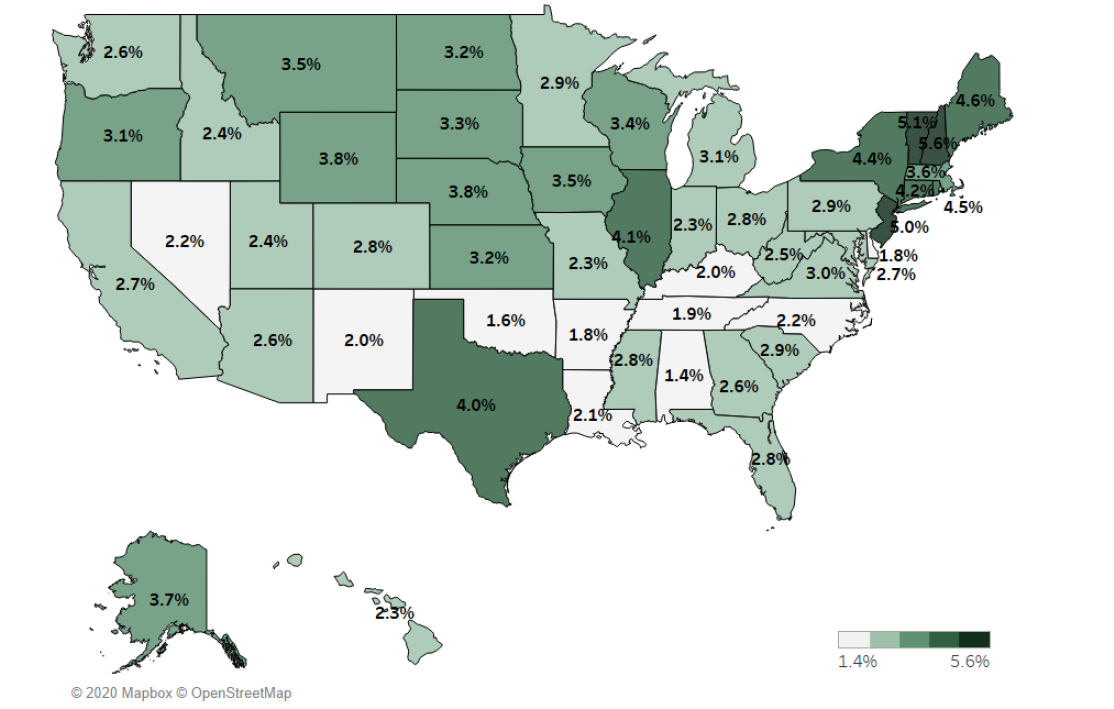

Nationwide, only Alabama depended less on property tax as a share of state and local tax revenue in 2017. In that year, Arkansans also paid the third lowest property tax per capita and the third lowest property tax per $1,000 in personal income (Figure 3).

Figure 3. Property Tax Revenue as a Percent of Personal Income, 2017

Source: Computed from U.S. Census Bureau and U.S. Bureau of Economic Analysis data