May 28, 2021

SIDEBAR:

Keys to solar: Net metering, meter aggregation, financial incentives

By Mary Hightower

U of Arkansas System Division of Agriculture

(423 words)

Newsrooms: This sidebar accompanies the main story found here. Additional additional art at https://flic.kr/s/aHsmVRKzi9)

Download Word version of story

FAYETTEVILLE, Ark. — A combination of policy and financial incentives have opened

the door to solar for agriculture operations in Arkansas. These include:

Net Metering

Net metering is a metering and billing arrangement designed to ensure fair credit for the owner/customer of a distributed generation system for electricity exported to the grid. In general, electricity produced by grid-connected solar system may be used by the business or flow to the utility’s distributed system to other users. With net-metering, the kilowatt hours produced by the customer and supplied to the grid offsets the kWh supplied to the customer in that month. For example, if the customer sends more kWh to the grid than used, the kWh charge is zero that month. The energy generated by the customer more than the electricity used is accumulated and credited to the account associated with the meter physically attached to the net metering facility in the next applicable billing period. The new net-metering rules allow existing agreements between net-metering customers and utilities to remain in place, or grandfathered, until 2040.

Meter aggregation

Meter aggregation expands options for customers that have multiple electric meters -- which is common in farming. Specifically, meter aggregation allows for a single generating system to be used to offset electricity use on multiple meters, without necessarily requiring a physical connection between the system and those meters. While meter aggregation has the potential to benefit many different types of customers such as commercial real estate, franchised businesses, and urban businesses without nearby land, it can be particularly beneficial for farms with multiple meters and/or electric accounts that are geographically dispersed. This potentially removes at least some of the obstacles associated with site limitations, allows customers to benefit from economies of scale in system sizing, and allows the use of underutilized land in system siting.

Financial incentives

There are tax credits and grants available for agricultural operations that wish to install solar:

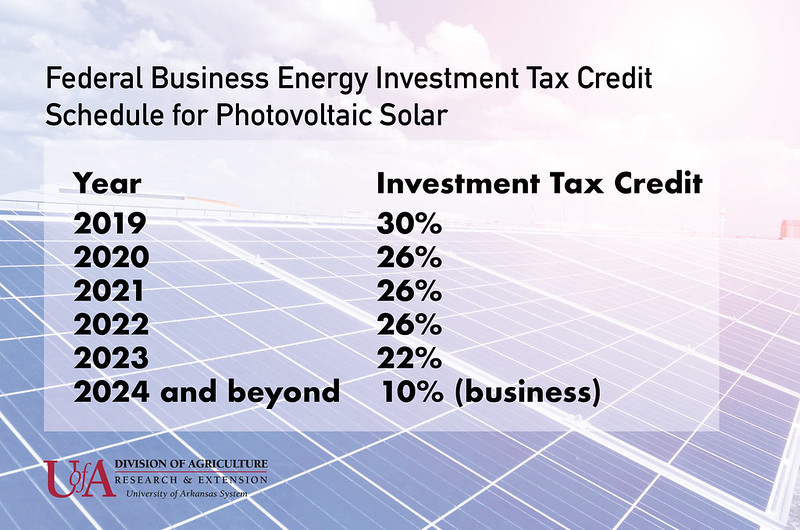

- There is a 26 percent federal investment tax credit, which is a dollar-for-dollar offset of federal tax liability; but the tax credit will taper after 2022, to 22 percent in 2023 to10 percent in 2024 and beyond.

- Solar owners can depreciate the entire system cost minus half the investment tax credit. The value of depreciation is dependent upon the entity and its tax liability.

- The Rural Energy for America Program, or REAP, from the U.S Department of Agriculture, can provide a grant for up to 25 percent of the total system cost. Hutchings said that “the paperwork isn't trivial, but your solar provider should be able to help you through it.”

Learn more about solar applications in ag: uaex.uada.edu/solar.

To learn about research and extension programs in Arkansas, contact your local Cooperative Extension Service agent or visit uaex.uada.edu. To learn more about Division of Agriculture research, visit the Arkansas Agricultural Experiment Station website: aaes.uada.edu. To learn more about the Division of Agriculture, visit uada.edu.

Follow us on Twitter at @AgInArk, @uaex_edu or @ArkAgResearch.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture offers all its Extension and Research programs and services (including employment) without regard to race, color, sex, national origin, religion, age, disability, marital or veteran status, genetic information, sexual preference, pregnancy or any other legally protected status, and is an equal opportunity institution.

# # #

Media contact:

Mary Hightower

mhightower@uada.edu

501-671-2006