July 16, 2021

BACK TO SCHOOL: College students should develop a plan to manage finances

By Mary Hightower

U of A System Division of Agriculture

Fast facts:

- Financial planning key for college students

- College student should develop financial goals

(684 words)

LITTLE ROCK —Tuition. Books. Various and sundry fees. There’s no doubt college students

face significant financial challenges. A little financial planning will go a long

way, said Laura Hendrix, associate professor and extension personal finance expert

for the University of Arkansas System Division of Agriculture.

“Many young adults are on their own in life for the first time when they go to college and little expenses can add up quickly,” she said. “Before you know it, you can reach hundreds of dollars a semester on incidentals.”

Hendrix said students who get a handle on money management “can avoid the stress of being unable to pay bills or the pressure of trying to work additional hours to stay afloat financially.

“Unfortunately, some graduates start their new lives weighed down with debt; but this doesn’t have to happen,” she said. “Basic financial management skills can help set students on the road to financial security.”

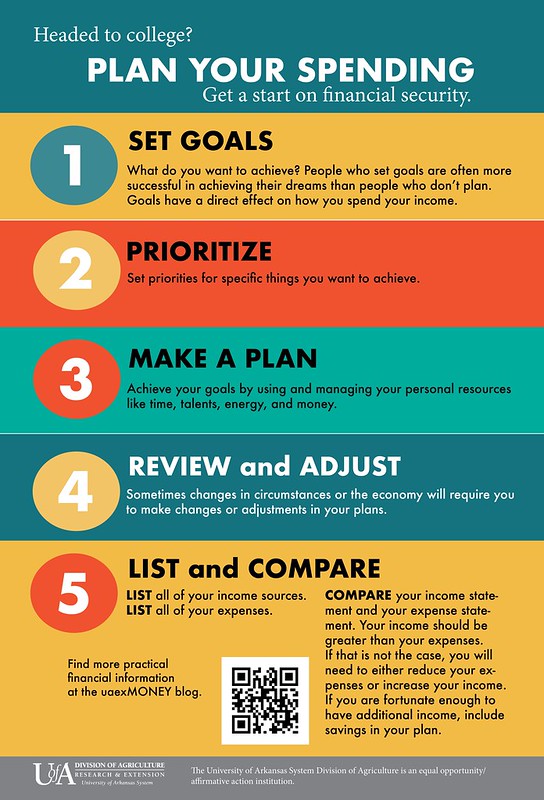

Hendrix recommends that college students:

- Set goals. People who set goals are often more successful in achieving their dreams than people who don’t plan ahead. Know where you are going and have a plan for how to get there. Goals have a direct effect on how you spend your income.

- Prioritize by thinking about what’s important to you. What are the realistic goals you can work towards? Set priorities for specific things you want to achieve.

- Make a plan. Achieve your goals by using your personal resources like time, talents, energy, and money.

- Review and adjust. Sometimes changes in circumstances or the economy will require you to make changes or adjustments in your plans.

Create a spending plan

The next step is to figure out just where that money will go.

“Planning is power and a spending plan is your most important financial tool,” Hendrix said. “A spending plan matches income with expenses and financial goals.”

To do this, students should:

- Make a list of all sources of income. This may include not only income from a job but also income from allowance or school assistance programs such as grants, scholarships and loans.

- List all expenses. It may be helpful to keep a spending journal for a month or two to make sure you aren’t forgetting anything. Examine these lists to determine the best use of your income. Are you using income to meet your goals? Look for ways to reduce or eliminate unnecessary expenses.

- Compare your income statement and your expense statement. Your income should be greater than your expenses. If that is not the case, you will need to either reduce your expenses or increase your income. You may need to make some changes in your spending habits so that you are spending does not exceed your income. If you are fortunate enough to have additional income, include savings in your plan.

Protect yourself

With scammers everywhere, Hendrix said it’s important for students to protect themselves by checking their credit report — even if they don’t use credit. The place to check it is here: https://www.annualcreditreport.com.

“It is a great way to monitor for fraud and identity theft,” she said. “Building a good credit score can make it easier to get a home or car loan in the future and you will qualify for better interest rates. The most important step to building a good credit score is to make regular, on-time payments and keep balances on credit cards low.”

Protect your personal financial information such as account numbers, passwords, and PINs. Shop with reliable vendors. Log out of online accounts and close browsers on shared computers or other devices. Don’t click on links in unfamiliar texts and emails. Shred mail and other documents that have personal financial information.

Shop smart

The pressures of exams, late night cramming may prompt students “to fall prey to impulse buying or comfort shopping,” Hendrix said. “Focus on your goals. Think about needs versus wants.

“Remember that advertisers and vendors are trying to influence your spending behavior,” she said. “Steer clear of sales pressure tactics and “too good to be true” offers. Set spending limits. Make shopping lists. Comparison shop. Plan ahead for large purchases.”

Find practical financial information at the uaexMoney blog; https://www.uaex.edu/life-skills-wellness/personal-finance/uaex-money-blog/.

To learn about extension programs in Arkansas, contact your local Cooperative Extension Service agent or visit www.uaex.uada.edu. Follow us on Twitter and Instagram at @AR_Extension. To learn more about Division of Agriculture research, visit the Arkansas Agricultural Experiment Station website: https://aaes.uark.edu. Follow on Twitter at @ArkAgResearch. To learn more about the Division of Agriculture, visit https://uada.edu/. Follow us on Twitter at @AgInArk.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture offers all its Extension and Research programs and services (including employment) without regard to race, color, sex, national origin, religion, age, disability, marital or veteran status, genetic information, sexual preference, pregnancy or any other legally protected status, and is an equal opportunity institution.

# # #

Media Contact: Mary Hightower

Chief Communications Officer

University of Arkansas System Division of Agriculture

mhightower@uada.edu

501-671-2006