July 2, 2020

Pandemic prompting rise in consumer savings

By Mary Hightower

U of A System Division of Agriculture

Fast Facts:

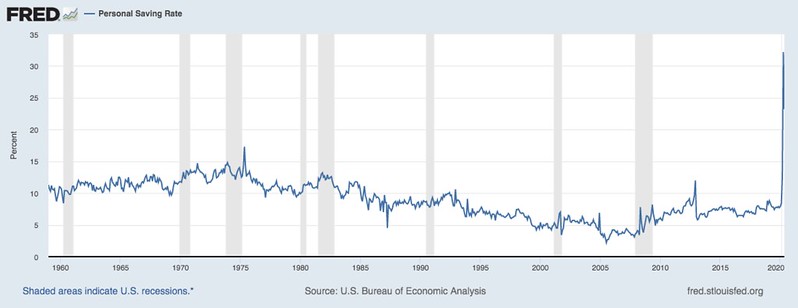

- Consumer savings reaches record levels in April

- Consumer savings exceeded 23 percent in May

- May rate is three times average rate

(769 words)

(Newsrooms: with graph, https://flic.kr/p/2jhcpzM and art https://flic.kr/p/2jh87Ak)

(Download this story in MS Word format here.)

FAYETTEVILLE, Ark. — If there’s a bright spot in the midst of the COVID-19 pandemic, it’s the rise in consumer savings.

The Bureau of Economic Analysis tracks the personal consumer savings rate, among other statistics. The personal savings rate is defined as the percentage of people’s income remaining after taxes and spending.

John Anderson, head of the agricultural economics and agribusiness department of University of Arkansas System Division of Agriculture and the Dale Bumpers College of Agricultural Food and Life Sciences, this week released an analysis of the May report from the Bureau of Economic Analysis, or BEA.

The World Health Organization declared a pandemic on March 11. Throughout that same month, consumers saved $2.17 trillion, a rate of 13.1 percent. In April, consumer savings rocketed to $6.15 trillion, a rate of 33 percent. April also saw real personal consumption expenditures decrease by $1.66 trillion.

“With disposable income down and personal consumption expenditures up, the savings rate retreated some from April’s record-shattering level,” said John Anderson. “Still the saving rate topped 23 percent in May — about three times the normal saving rate.”

In records stretching back to 1959, April’s savings were the second highest rate since it peaked at 17.3 percent in May 1975. At the time, the United States and other industrialized countries struggled with a recession sparked in part by the 1973 oil crisis. The peak occurred several months after President Gerald Ford initiated his “Whip Inflation Now” campaign, encouraging people to slow spending, save money and try to keep wages stable.

Consumer spending matters

Anderson said that consumer spending is the most significant component of a country’s gross domestic product, or GDP.

“For example, in this year’s first quarter, the GDP was $21.5 trillion; personal consumption expenditures accounted for $14.6 trillion — 68 percent — of that amount, according to the BEA,” he said.

“As noted last month, the high savings rates suggest the financial fuel for economic recovery is in place once consumer confidence returns,” Anderson said. “To the extent that consumers remain reluctant to spend, that makes it much more difficult for the economy to pull out of recession.

“Of course, saving is a generally positive behavior, and saving in response to an increase in risk is a sensible thing to do individually,” he said. “It’s just that the aggregate effect of everyone doing the same thing at the same time can be negative.”

Staying in the habit of saving

“We are happy to see the higher savings rates but it might give the mistaken impression that everyone in the country is flush,” said Laura Hendrix, associate professor and extension personal finance expert for the Division of Agriculture. “While folks at higher income levels are able to save, many consumers living month-to-month still struggle to earn enough income to make ends meet.”

Saving money is a good habit to continue. The Cooperative Extension Service recommends maintaining an emergency fund of three to six months of income.

According to FINRA, the investor education foundation, half of all Arkansans lack a rainy day fund. (See: https://www.usfinancialcapability.org/results.php?region=AR)

“‘Financial resilience’ is a term we are hearing more often,” Hendrix said. “One component of financial resilience is a healthy savings fund. Financial resilience means that you can weather the storms of life — paying bills on time, making ends meet, preparing for the future — even in times of economic crisis. An emergency savings fund is one component of financial resiliency.

She said, “one question I've had from consumers is ‘shouldn't we be spending now to help stimulate the economy?’ The answer is ‘It depends.’

“For consumers who have plenty of extra income and know they won't have any trouble making ends meet even in the face of another economic downturn — the answer may be ‘yes,’” Hendrix said. “For those Arkansans who were already living month-to-month, now is the time to save extra income or windfall income such stimulus payment, tax refund, additional unemployment benefits so that you can build an emergency fund that will be a safety net.”

She said “the idea is to that you would have enough money to cover all of your expenses for several months in the event of a financial crisis” which could include being furloughed, laid off or being out of work for an extended period of time due to an illness.

The Cooperative Extension Service has information on personal finance and savings at www.uaex.uada.edu/money.

Anderson’s report is part of the department’s weekly analyses of the impact of COVID-19 on the economy.

To learn about extension and research programs in Arkansas, visit uada.edu, Follow us on Twitter at @AgInArk, @uaex_edu or @ArkAgResearch.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture offers all its Extension and Research programs and services (including employment) without regard to race, color, sex, national origin, religion, age, disability, marital or veteran status, genetic information, sexual preference, pregnancy or any other legally protected status, and is an equal opportunity institution.

# # #

Media Contact: Mary Hightower

Chief Communications Officer

University of Arkansas System Division of Agriculture

mhightower@uada.edu

501-671-2006