Aug. 24, 2020

Income Tax School offers training in current tax regulations, changes in tax law

By Tracy Courage

U of A System Division of Agriculture

Fast facts:

- In-person, online options available

- Participants earn 16 IRS-approved continuing professional education credits

- Register at http://taxschool.uada.edu

(303 words)

(Download this story in MS Word format here.)

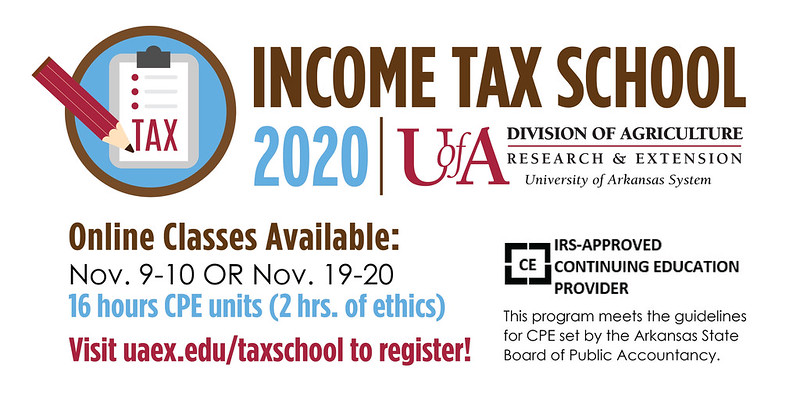

LITTLE ROCK — Registration is open for the Cooperative Extension Service’s Income Tax School, which is designed to help tax preparers get ready for the 2021 tax season.

The two-day courses, offered through the University of Arkansas System Division of Agriculture, provide tax preparers — and anyone interested in advanced income tax preparation — with the latest updates in the tax code and a review of current tax law. Courses will be offered in-person and online on these dates:

- Nov. 3-4: On-site, Cooperative Extension Service state office, 2301 S. University Ave., Little Rock

- Nov. 9-10: Online

- Nov. 19-20: Online

The online courses will be live webinars delivered via Zoom videoconferencing. Training materials will be mailed to participants before the classes.

For the in-person training, seating will be limited to allow for social distancing.

“We will be following the Arkansas Department of Health guidelines and protocols to keep everyone safe,” Kim Magee, extension community, professional and economic development program associate, and tax school director for the Division of Agriculture, said. “Should the in-person event need to be canceled due to COVID-19, registrants will have the option of transferring to one of the webinars.”

The Income Tax School is approved by the IRS as a continuing education provider. Participants can earn 16 hours of continuing professional education credit, including two hours of ethics.

Classes run from 8 a.m. to 4:30 p.m. each day, with a one-hour lunch break. A certificate of attendance will be emailed within three weeks of completion of the course. The cost of a two-day course is $250 before Aug. 30 and $310 after Aug. 30.

For more information, contact Nikki Dawson at ndawson@uada.edu or (501) 671-2003.

To learn more about educational opportunities in your community, contact your local Cooperative Extension Service agent or visit www.uaex.uada.edu. Follow the Cooperative Extension Service on Twitter at @AR_Extension.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture offers all its Extension and Research programs and services (including employment) without regard to race, color, sex, national origin, religion, age, disability, marital or veteran status, genetic information, sexual preference, pregnancy or any other legally protected status, and is an equal opportunity institution.

# # #