Why pay when you can file taxes for free?

Fast facts

-

- Shop around, certain taxpayers may be eligible for free filing.

- VITA is an in-person tax filing option

- IRS has partnership to offer free online filing, https://www.e-file.com/.

(340 words)

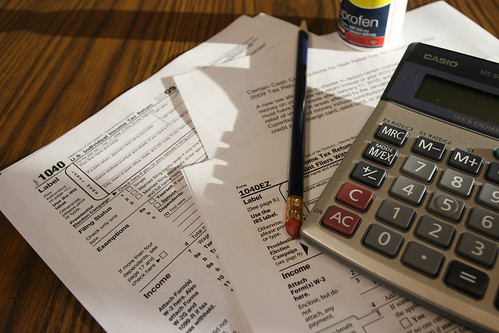

LITTLE ROCK – For those who need help with filing taxes, there are options to have

those1040s file for free, said Laura Connerly, assistant professor for family and

consumer economics with the University of Arkansas System Division of Agriculture.

“Commercial tax preparers charge from $55-$100 for a basic return,” she said. “Products such as refund anticipation loans and refund anticipation checks add $60 or more in extra fees.”

However, Connerly said there are options at every income level. And while those with complicated returns may need help from professional tax preparers, the average tax filer can save a lot by using a free service.

Here are some options to consider:

Online - IRS Free File is a partnership between the IRS and the Free File Alliance. Use Free File Software if your income is $60,000 or less and Free File Fillable Forms if your income is greater than $60,000. Find more information about IRS Free File at https://www.e-file.com/.

My Free Taxes is step-by-step online filing for individuals and families with incomes of less than $60,000. The 2014 MyFreeTaxes Partnership campaign, now in its sixth year, allows free, online federal and state preparation and filing in all 50 states. Learn more about tax credits and file free with My Free Taxes at www.myfreetaxes.com

In person - Volunteer Income Assistance, or VITA, sites can be found in community centers, libraries, schools, and other local places. Trained volunteers provide tax preparation for filers with household incomes of $53,000 or less. The AARP Tax Aide program offers free tax help to people ages 60 and up. AARP volunteers provide in-person assistance at sites in local communities. To find the nearest VITA site, call (800)-906-9887. To locate an AARP site call 888-227-7669. Look for VITA or Tax Aide sites online at http://irs.treasury.gov/freetaxprep

The Cooperative Extension Service is your source for reliable, research-based information to improve quality of life. Discover the latest recommendations for money management, nutrition, health, parenting, relationships, and personal development. Visit our website at www.uaex.uada.edu.

The Arkansas Cooperative Extension Service is an equal opportunity institution. If you require a reasonable accommodation to participate or need materials in another format, please contact your County Extension office (or other appropriate office) as soon as possible. Dial 711 for Arkansas Relay.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture offers all its Extension and Research programs and services (including employment) without regard to race, color, sex, national origin, religion, age, disability, marital or veteran status, genetic information, sexual preference, pregnancy or any other legally protected status, and is an equal opportunity institution.

By the U of A System Division of Agriculture

Media Contact: Mary Hightower

Dir. of Communication Services

U of A Division of Agriculture

Cooperative Extension Service

(501) 671-2126

mhightower@uada.edu

Related Links