Realistic Expectations About Finances

Nashville, Ark. – Are you starting a new chapter in your life? It may be graduating college, getting that first real job, or marriage. While all of these life-changing events are exciting, they can also be a little scary, especially when it comes to financial matters. If you have never had to experience paying for your own expenses, such as rent, utilities, and even buying groceries, the price of these items may come as a complete surprise! You may discover that these expenses eat up most of what you bring home in your paycheck. For many young people and couples, this may be the first major hurdle you will face.

Saving Money Takes Planning

All of us have personal goals we want to achieve. It may be a new car, new furniture or even going to a concert to see our favorite singer or band. Saving for any of these goals takes planning. As a single person, it may be easy to plan. Add another person to mix, through marriage, and it can be much more challenging. One person may be dreaming of the latest thing in technology to purchase, and the other person may be determined to pay off debt. When goals are different, frustration can set in. One reason couples become financially strapped is they have not thought through their goals together, so they are working at cross-purposes, or they let their income slip through their fingers.

There are three types of goals to focus on:

- Short-term goals are goals that can be met in one year. Examples of short-term goals are increasing

your savings account, going on a vacation, buying furniture.

- Intermediate goals can be accomplished between one to five years. These might include purchasing a new

or used vehicle or making an improvement on a home.

- Long-term goals are those requiring five years or more to achieve. Examples of this goal include purchasing a house, setting up a college fund for your children, or planning for retirement. With goals as a guide, every financial decision becomes easier.

For long-term goals, you will need to factor in the impact of cost increases. To plan future expenses, you must consider inflation. If you plan to take a dream vacation on your tenth anniversary, you will need to know the current cost and then increase the amount for inflation. Most experts agree upon a 3 to 4 percent increase annually.

Financial Tips for Newly Weds

If you are newly married, sit down together and plan some goals you want to achieve. Each person should list their own goals and then work together with their spouse to come up with some goals you can achieve together. If you do not agree on a goal, where or how can you compromise?

Each person needs to be willing to rethink their own personal goals. They may have to downsize their goal. Some couples find that posting a goals list in their home is very helpful. Seeing your goals every time you go to the refrigerator can help you stay focused on the big picture.

For most couples, the money they have to spend, save, and invest is earned through work. Two-earner families are the norm in today’s world. Surprisingly, most couples marry without having any discussions about money, including how much each spouse earns, how much they will earn together or what their plans are for earning money in one year or five. They may not even know if their combined salaries are enough to cover their current expenses. Even though finance matters are not a romantic topic, it is a realistic fact and is the cause of disagreements in a marriage.

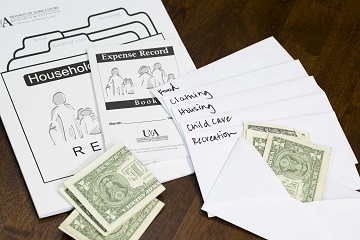

Before marriage, it is important to plan for both your expenses and income. Income and expenses statements let you see what money is coming in and where it goes. This is basic budgeting.

Keep in mind the amount of money you earn has nothing to do with how well you manage it. People who earn large amounts of money can have just as much trouble making ends meet as people who earn very little. However, through careful managing, you should be able to achieve your financial goals, regardless of your income.

We have a great series of fact sheets to help newlyweds through the first year of marriage.

The program, “Financial Smart Start for Newlyweds” is available at no charge from the Howard County Extension Office! Visit our office located on the second floor of the courthouse or call us at 870-845-7517.

Recipe of the Week

Here is a recipe shared by Jean Ann Flaherty, a member of Twilight EHC Club. She prepared this recently at the “Healthy Cast Iron Cooking.” It received rave reviews. This recipe is great for any summertime occasion. Especially great for backyard get-togethers or camping. Make it ahead of time so flavors can meld. Be sure to consider food safety if you are serving it outside. Keep cold foods cold!

Picnic Slaw

-

1 green cabbage (shredded)

-

1 bunch celery, diced

-

1 large onion, diced

-

6 Tablespoons sweet pickle relish, drained

-

4 Tablespoons sugar

-

1 ½ cup mayonnaise

-

2 Tablespoons vinegar

-

Salt and pepper, to taste

-

Mix all ingredients together.

-

Refrigerate until ready to serve.

-

Stir before serving.

Note: To save time, use the bagged shredded cabbage. However, you will spend more for this convenience.

By Jean Ince

County Extension Agent - Staff Chair

The Cooperative Extension Service

U of A System Division of Agriculture

Media Contact: Jean Ince

County Extension Agent - Staff Chair

U of A Division of Agriculture

Cooperative Extension Service

421 N. Main St, Nashville AR 71852

(870) 845-7517

jince@uada.edu

Related Links

The Arkansas Cooperative Extension Service is an equal opportunity institution. If

you require a reasonable accommodation to participate or need materials in another

format, please contact your County Extension office (or other appropriate office)

as soon as possible. Dial 711 for Arkansas Relay.

Pursuant to 7 CFR § 15.3, the University of Arkansas System Division of Agriculture

offers all its Extension and Research programs and services (including employment)

without regard to race, color, sex, national origin, religion, age, disability, marital

or veteran status, genetic information, sexual preference, pregnancy or any other

legally protected status, and is an equal opportunity institution.